http://seekingalpha.com/author/alphatraderx

The Future of Energy

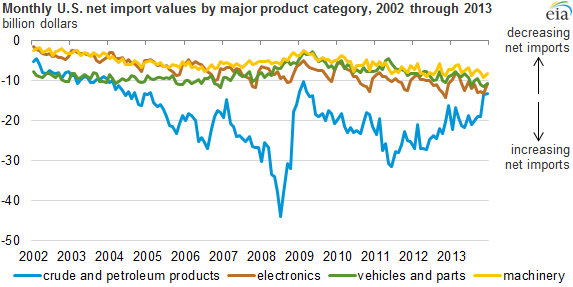

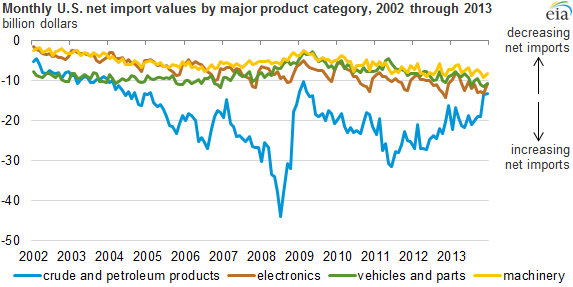

The United States is becoming more energy independent every year as new technology and natural gas reserves reduce the need for energy imports. Below is a chart from the U.S. Energy Information Administration depicting net import trends over the years.

-Source U.S. Energy Information Administration

New technology is enabling energy companies to extract oil and gas more effectively than ever before. Although the U.S. is actually still a net importer of oil, many articles in recent news confuse being a net exporter of oil with oil products; the U.S. is a net exporter of energy products such as gasoline, but those products are the result of the net imports refined into gasoline. As the U.S. becomes more energy independent and trends towards being a net exporter of natural gas and oil, the companies ahead of the curve are set up to return large gains for investors. It is expected that natural gas reserves contain more than 100 years worth of gas and only 11% of that is being tapped into.

The newest technology allowing companies to extract natural gas from shale is hydraulic fracturing, known as fracking. The technology has been around for some years but new formulas for the pressurized water make fracking less hazardous to ground water and more widely accepted by the general public. Today about 25% of total U.S. dry gas production is done with hydraulic fracturing and it is expected by 2035 that about 50% of total U.S. dry gas production will be done with hydraulic fracturing.

Companies that create and innovate better technology for hydraulic fracturing, sell and lease equipment, and produce natural gas are positioned for future gains as an energy play. I will discuss three companies one each at a different level of the supply chain. Parker Hannifin (PH), National Oilwell Varco (NOV) and Chesapeake Energy (CHK).

Parker Hannifin

Parker Hannifin , a Cleveland, OH based company, is a leader in hydraulics and is investing in the development of new technology to make drilling for shale gas more efficient. They are working with builders to create oil rigs that are able to produce more pressure for drillers that weigh less and are easy to move. PH's current exposure to the energy market is growing fast and it expects to see large growth in sales from this business. Below are a few quotes from Sales Managers Rick Carnes and Doug Gilbert regarding hydraulic fracturing:

"(Shale gas) is one of the markets that's really bought in to it and utilizes it, because it's all about speed lately," Mr. Gilbert said.

"We've seen a boom associated with that, simply because of the sheer demand from everyone racing to drill for as much natural gas as possible," he said.

"We fabricate the pipes and make everything in our shop and send out a kit that can be assembled in a matter of days, as opposed to weeks," Mr. Carnes said.

Parker Hannifin is a great value company set up for huge growth opportunity with their innovation to develop better hydraulic fracturing products allowing companies to drill for natural gas faster and safer than ever.

PH also has a long history of solid financial performance. The company is only trading at 17.5 times earnings, has a PEG ratio of .9, a current ratio of 1.74, and working capital of $2.5B as of 12/31/2013. These are few fundamentals of many that prove PH's strong financial position. PH also pays quarterly dividends annualized at a range of 1.6-2.2% every year. PH is at the top of my list for long term growth and I put a strong buy on the company.

National Oilwell Varco

Next, a company that sells and leases oil equipment is National Oilwell Varco . Recently Warren Buffet's Berkshire Hathaway (BRK.A) (BRK.B) acquired a position in NOV. NOV has a P/E ratio of only 14.18, current ratio of 4.5 and working capital of $9.75B. NOV is investing a lot of cash in into drilling equipment which it leases to drilling companies drilling for untapped natural gas and oil reserves. With only 11% of expected reserves being drilled, many more companies will be setting up oil rigs and demanding more of NOV's products far into the future making NOV a great long term growth energy play. National Oilwell Varco also offers quarterly dividends annualized at 1.35% at current the current stock price.

Chesapeake Energy

Finally companies drilling for natural gas are positioned for large growth in the future. These companies are taking advantage of new technology offered by companies like NOV and developed by companies like PH. One leader and company investing in the future of energy and producer of shale gas is Chesapeake Energy . CHK is increasing its production of shale gas at rapid rates. Some of its locations are expected to double the current output by the end of 2014. CHK is also investing a lot of capital in new products to extract shale gas in places it couldn't before and they are increasing the amount of wells in which they drill from. Since Q1 2013 CHK had capital expenditures of over $4B to purchase or lease equipment reaching more gas reserves than ever. These purchases, along with others are the main driver for the mediocre financial ratios and balance sheet. Currently the company is trading at 19.07 times earnings and has a PEG ratio of .87; they also pay quarterly dividends annualized at 1.35% of current stock price. CHK is investing heavily in the future of natural gas production and as the country continues to be more environmentally conscious the demand for natural gas will be a huge catalyst for this company.

Overall the energy industry is reshaping itself and leading are these three forward looking companies, investing in the future of energy. This provides investors opportunities to be ahead of the curve and invest at bargain prices. While there will obviously be short term gains and losses in any investment, investing in this industry through these companies will provide long term growth and annual income through dividends.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article

No comments:

Post a Comment